If you want a place where you can track your loan(s) and where you can also calculate how long it will take to payoff your loan, then this Google Sheets loan payoff template will be the perfect tool for you to do exactly that.

Keeping track of your loans is much easier and less stressful when you have a nice organized place to keep them.

Also, having the ability to see how an increased payment will decrease the amount of time it takes to payoff your loan, as well how it will decrease your interest paid in the long run… can be very inspiring, and can give you the push that you need to set a bit of extra money aside for your monthly loan payments.

Get the loan payoff calculator template

*Note that the cells that should not be edited in this template will display a warning message if you try to edit them.

See more Google Sheets templates

Get the Google Sheets formulas cheat sheet

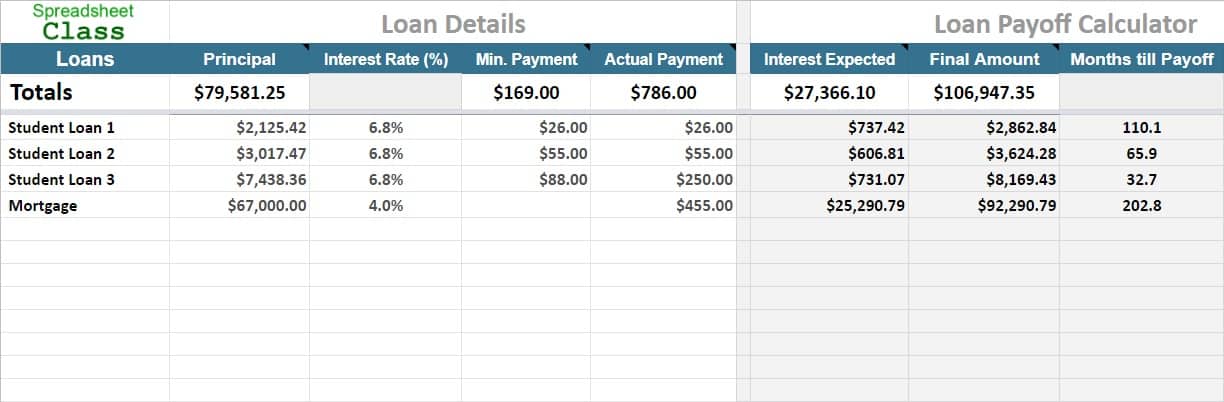

This loan payoff template will allow you to track and calculate the months/years until payoff for multiple loans, whether you are wanting to track your student loans, your mortgage, or any other fixed rate loan.

Below is a general explanation on how the loan payoff calculator template works, and then after that I will give you specific instructions on how to use the template.

The following values are the most important to fill in the template, as they directly affect the payoff calculations:

- Principal balance

- Interest rate

- Actual payment amount

There is also a place for you to name the loan, as well as a place to enter your minimum monthly payment. Note that the minimum monthly payment does not affect the calculations in this template. The “Actual Payment” is what you should adjust to see your payoff information. (See the bottom of this page for definitions of varying loan terminology)

After entering your principal balance, the interest rate, and the actual payment amount, the following information will calculate and display on the right side of the template:

- Interest expected

- Final amount

- Months till payoff

- Years till payoff

There are also totals that will calculate at the top of the sheet, on columns that have dollar amounts.

So you will be able to see how long it will take to payoff your loan, how much interest you can expect to pay, and the total amount of money that you should expect to pay with interest included. Then you will be able to see how this information changes as you enter different values into the sheet.

Get your copy of the loan payoff calculator template

How to use the Google Sheets loan payoff template:

- Enter the loan name in column A

- Enter the principal balance in column B

- Enter the interest rate in column C (This column is already in percentage format)

- Enter your minimum payment amount in column D (Remember this does not affect the calculation)

- Enter your actual payment amount in column E

How to decrease payoff time and interest paid for loans

With a fixed rate loan, you will have a certain amount of interest that you must pay each month, based on your current principal balance and your interest rate. This means that only what is left over after paying interest, is applied to your principal balance.

This is why a lower payment actually benefits the lender more than you… because with a lower payment, less is paid towards your principal balance each month, and therefore you will have to pay more months of charged interest in the long run.

This is also why increasing your monthly payment will significantly reduce the amount of interest that you pay in the long run. More money will be applied to the principal balance each time you pay, and in doing this you not only reduce the amount of Interest that will be charged on each proceeding payment, but you also reduce the number of periods that you will be charged interest for over the entire course of payment.

In other words, increasing your monthly payment makes a huge difference that greatly benefits you!

Loan terminology

Principal balance: The amount that you actually borrowed, without interest added

Interest rate: The percentage of the principal balance that is charged for each period

Minimum payment: The minimum amount you are required to pay each period; This is determined by the bank or lender

Extra terminology for the loan payoff template

Actual payment: This is the amount you are actually paying each month, or that you intend to pay from here forward

Interest expected: The total amount of interest you should expect to pay on your loan

Final amount: This is the total amount you can expect to pay, with interest included

Months till payoff: The number of months that it will take to payoff the loan

Years till payoff: The number of years that it will take to payoff the loan